Driven Mobile App:

2022-present

DRIVEN is dedicated to supporting the growth of small businesses throughout Canada by providing the necessary financial assistance. The forthcoming mobile app, in its ultimate form, aims to enhance the current web interface. In addition to securing pre-approval for credit and obtaining loans, our customers will have the ability to meticulously monitor the status of their loans. For small business proprietors, loans are akin to typical expenses such as rent, payroll, and energy costs. Having the ability to forecast upcoming financial commitments over the next few days holds significant value for them.

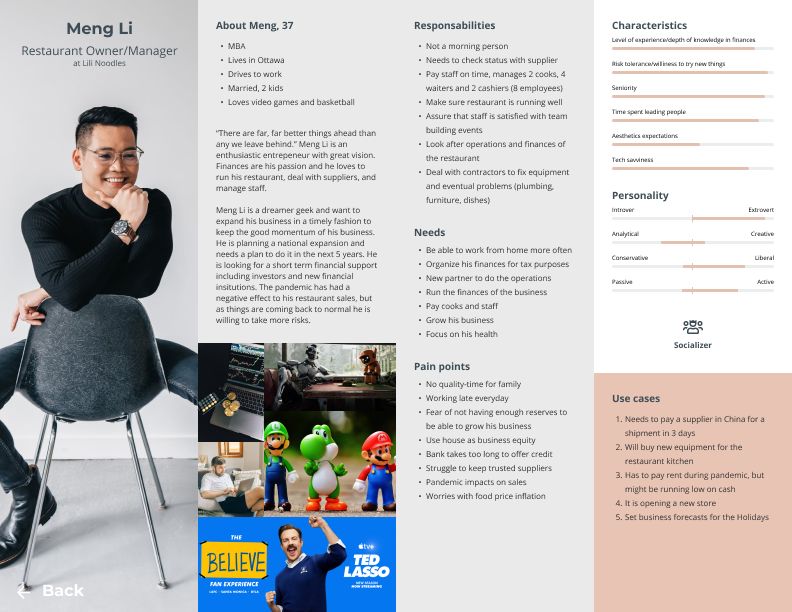

Small business owners.

Who comprises this group? To address this query and establish detailed personas, I suggested organizing a workshop in collaboration with the Product team. Drawing insights from customer data, we identified four distinct personas, enabling us to gain insight into the requirements and challenges faced by our customers. Subsequently, we developed user journeys tailored to accommodate specific mobile app use cases.

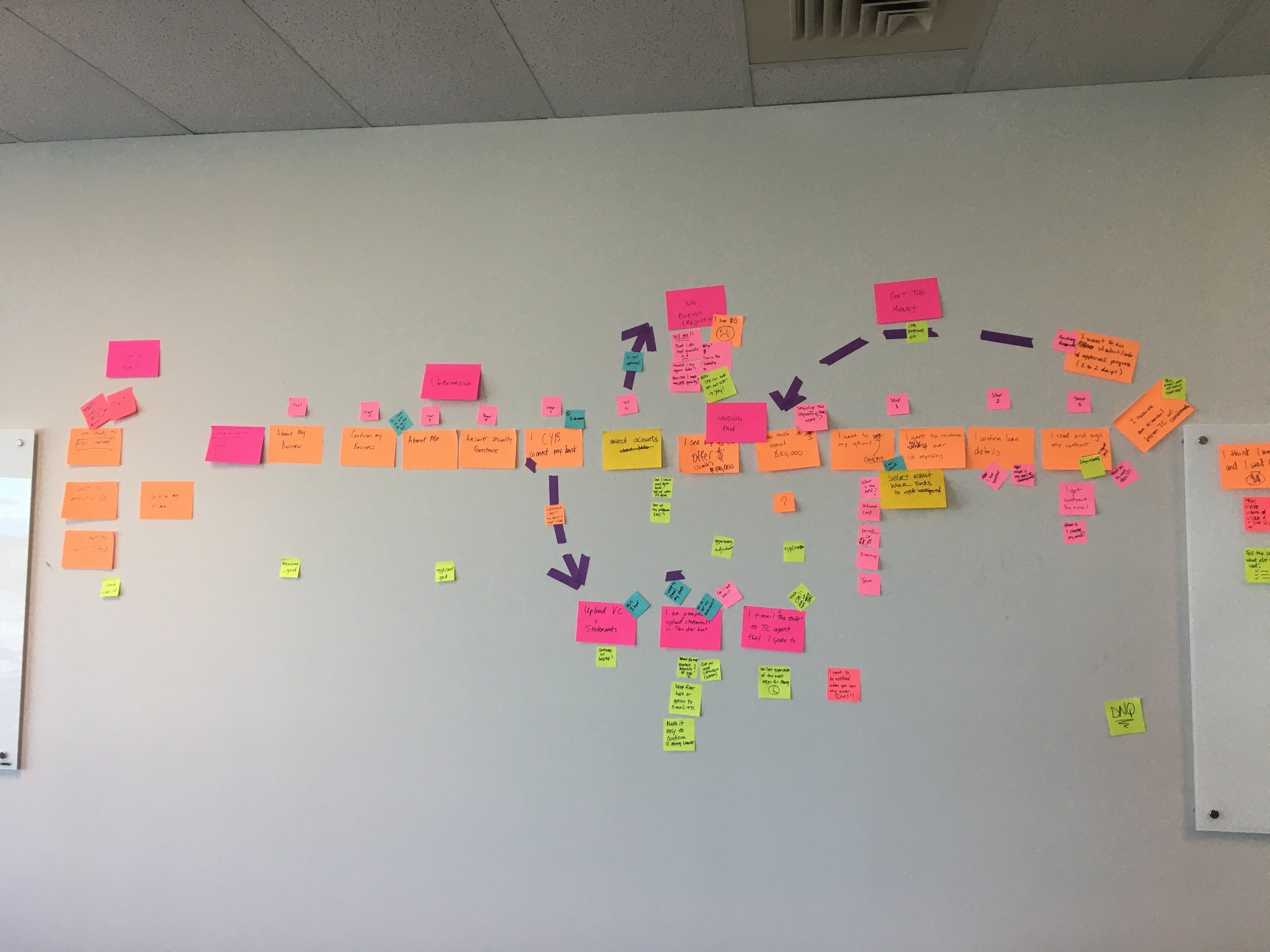

Journey map

User interview results

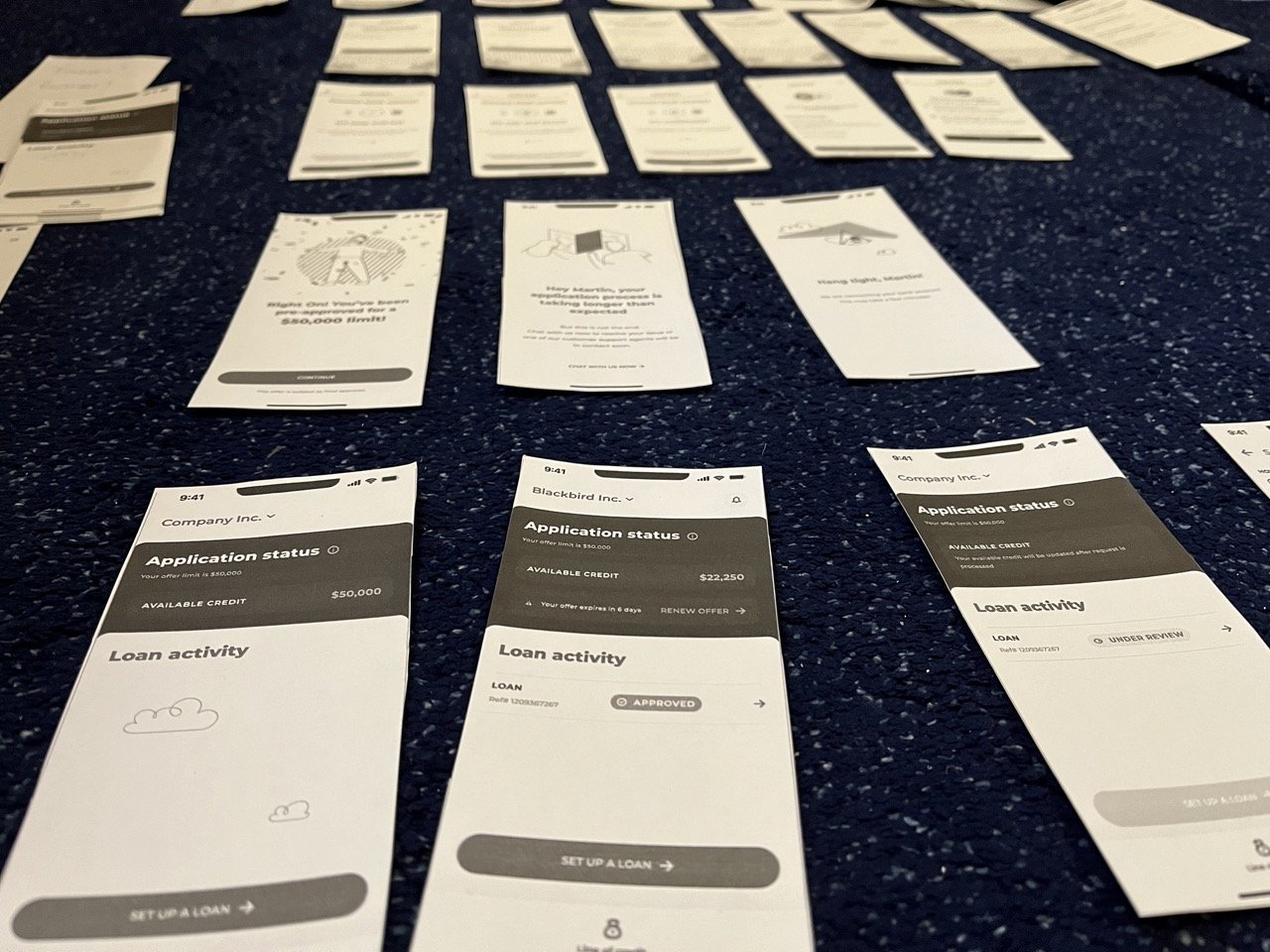

Exploration

We used sketches, paper prototyping, and testing to generate potential solutions for our customers.

Solution

The initial version of the app focused on customers who already have loans. We prioritized their needs, which included tracking loan activity, knowing the date of their next payment, and making the loan application process quick and easy.

App launch.

Opening the app prompts users with face ID on sign-in and brings them directly to their Available Credit and Loan Activity.

Loan request and management

In the app, customers are able to easily apply for a loan and track existing loans and upcoming payments. This is particularly useful as they can plan their expenses ahead of time and make sure payments won’t be missed.